Each criterion is allocated a specific number of points, contributing to the overall assessment of project proposals for grants or grant loan combinations. Below is a breakdown of the evaluation criteria and their respective point allocations:

Applicants are required to address these criteria comprehensively in their project proposals to increase their chances of receiving funding.

The point breakdown system allows for a structured and transparent evaluation process, ensuring that projects with the greatest potential to address rural broadband challenges and benefit underserved communities are prioritized for funding.

The inclusion of specific criteria, such as Net Neutrality, underscores the USDA's commitment to promoting fair and equitable access to broadband services.

The evaluation criteria serve as a comprehensive framework for assessing project proposals and guiding investment decisions in the ReConnect Program's current funding round.

Service Area Map

Respondents must provide a map of their service area that overlaps with the proposed funded service area as part of their application.

Respondents must also provide:

- Details of the premises within the proposed funded service area to which they can provide 100/100 Mbps broadband service

- Number of existing customers that receive broadband service in the proposed service area

- Maximum download and upload speeds that they offer in the proposed service area

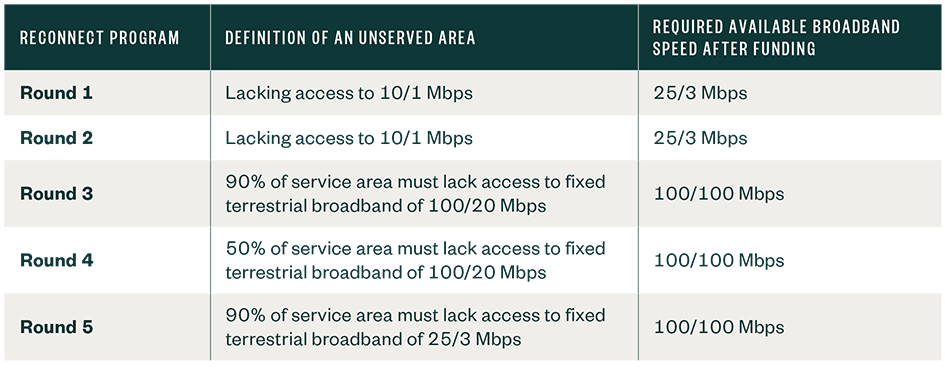

The USDA requires the Federal Communication Communication’s (FCC) National Broadband Map to be used as a source to demonstrate lack of sufficient broadband service of an eligible area. Local speed tests performed in the proposed service area may be included, particularly if the applicant is disputing the FCC’s reported service levels in the FCC’s National Broadband Map.

How May ReConnect Funds Be Used?

ReConnect Round 5 funds must be used for deploying broadband facilities capable of providing at least 100/100 Mbps broadband service.

Funds may be used for qualifying preapplication costs associated with developing the application, such as:

- Engineering

- Financial forecasting

- Project management

- Environmental review

All ReConnect Program funds must be drawn within five years of the date that funds are made available to the applicant.

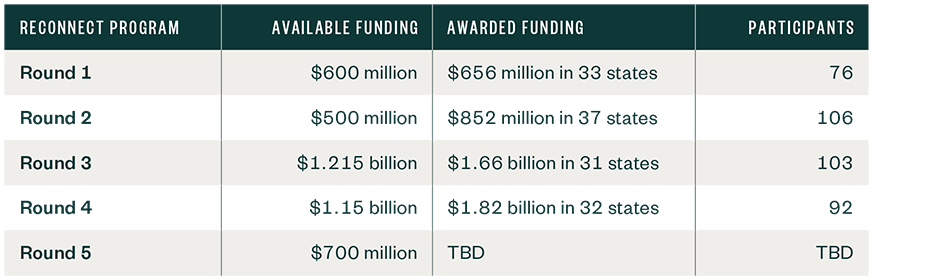

What Can Applicants Learn from Previous Rounds of the ReConnect Program?

Among key lessons from previous rounds of the ReConnect Program was the significant demand for reliable high-speed internet in rural area, particularly the pressing need for continued investment in broadband infrastructure.

The importance of collaboration between various stakeholders, including internet service providers, local governments, and community organizations, was also underscored. Successful projects often involved partnerships that combined resources and expertise to maximize the impact of funding.

The importance of leveraging innovative technologies, such as fiber optics and licensed fixed wireless, to efficiently deploy broadband networks in rural regions was emphasized.

Streamlined application processes and clear eligibility criteria to ensure that funds are allocated effectively and efficiently are also important.

How Should Applicants Prepare for Round 5?

Data from previous rounds of the ReConnect Program can help applicants prepare for future rounds of funding.

There are a few strategies applicants can implement to help boost their application, further detailed below.

Focus on High-Scoring Criteria

Applicants should be prepared to seek out the highest scoring areas within their service area and limiting their application to only those areas that meet multiple criteria.

Round 4 was the most competitive yet, and future rounds are likely to be even more so. Applicants can’t change scoring based on geographic areas defined by other programs—such as the economic need or social vulnerability of a community. The proposed funded service area can be gerrymandered to produce the highest score possible.

Applicants can meet additional scoring criteria if they’re willing to prepare in advance.

Example

Strong labor standards can boost a score, but the applicant must implement the provisions of the Davis-Bacon Wage Act, which requires significant preparation and knowledge.

Prepare Early

All applicants, including those pursuing 100% loan funding, should prepare early, as 100% loan funding is awarded on a first-come, first-served basis.

Applicants should have:

- Engineering designs

- Network costing

- Location and subscriber data

- Environmental analyses

- Financial forecasts (if applicable)

- Two years of audited financials

- System for Award Management (SAM.gov) registration and unique entity identifier (UEI) number assigned

- Level II e-Authentication

Steps to prepare for the application process:

- Establish USDA Level II e-Authentication for each person who will access the application portal

- Gather all relevant corporate documents

- Prepare historical financial statements in RUS format

- Summarize location and subscribership data by area

Determine Eligibility

All broadband providers are eligible to participate in the ReConnect program except individuals and general partnerships formed with individuals.

Co-applicants aren’t eligible; one entity must submit the application.

To be eligible for ReConnect funding, an applicant must:

- Submit a complete application and all supporting documentation

- Demonstrate that the project can be completed within five years

- Demonstrate that the project is technically feasible

- Demonstrate that all project costs can be fully funded with grant, loan, or matching funds

- Show that the project is financially feasible and sustainable

- Demonstrate that the proposed broadband services will be provided during the economic life of the assets or the loan’s term

Other Factors to Consider

The application process is extensive and requires vast amounts of information and effort from a variety of internal departments and may also depend on assistance from external advisors.

- Start early

- Dedicate the necessary time to thoroughly prepare an application

- Take a structured approach to the process

Applicants are generally provided with 90 days to apply once the Notice of Funding Opportunity (NOFO) is released, and in many cases, a complete and successful application may take the entire time. You’ll want to make sure that your team understands relevant deadlines, knows their responsibilities, and works cohesively towards project completion.

What Are the Considerations of Grants Versus Loans?

Applicants can consider how competitive their proposal might be within a grant program to determine if a grant or a loan is a better fit for their project.

Companies should also analyze the accounting policy that fits their circumstances. The taxability of grants received could significantly impact the timing of cash flows and should be analyzed when undergoing the application process.

Accounting and tax considerations for loan proceeds remained unchanged from other loan programs.

Example

If a proposed funded service area scores highly within the evaluation criteria, applicants may consider applying under the 100% grant category.

If eligible entities think they’ve scored adequately but not as top scorers, the 50% grant and 50% loan option may be less competitive, while a lower scoring entity with a proposed eligible funded service area may opt for a 100% loan where applicants don’t have to compete on score.

Companies should also analyze the accounting policy that best fits their circumstances for grant proceeds received. The taxability of grants received may have significant impacts on the timing of cash flows and should be analyzed when undergoing the application process.

Accounting and tax considerations for loan proceeds remained unchanged from other loan programs.

Are There Taxable Income Differences Between Grants and Loans?

Grant funds are generally considered taxable, but taxability timing would depend on how records have been kept. If a company receives a loan instead of a grant, the amount received in loan proceeds wouldn’t be taxable. In both scenarios, the assets are recorded at their gross cost and allowed to be depreciated.

The main consideration between grant or a loan is the overall cash flow impact, where loan proceeds will have to be paid back. A company that receives a $1 million loan must pay back that amount—plus any interest.

If the amounts are received as grants, then a company will have to pay tax of approximately $210,000 to $300,000. While proceeds aren’t taxable in a loan scenario, the overall cash payout will be more than if the funds are received as a grant.

Other Important Considerations for the ReConnect Program

Below are other important considerations that could impact eligibility or how to approach the application process for round five and beyond.

Accounting for Funds

Accounting for grant proceeds will vary between funds received for projects in regulated service areas versus projects in nonregulated service areas.

Regulated Projects

Grants received for regulated projects will be accounted for as a reduction to the cost of the plant added in accordance with the FCC’s rules on aid to construction in Part 32.2000.

Nonregulated Projects

Companies that receive grants for nonregulated projects have the option to account for the proceeds as a reduction to plant or deferred revenue. Under the deferred revenue option, the liability is amortized over the average life of the plant placed in service.

The primary difference is the impact on the income statement.

Grant proceeds recorded as a reduction to plant will have lower depreciation expenses annually as the depreciable base is reduced by the grant amounts. Grant proceeds recorded as deferred revenue will result in higher depreciation expenses and increased revenue.

Net income should be comparable under each method. However, the accounting policy elected will impact the timing of tax payments and should be discussed with a tax advisor.

Loans received from the ReConnect Program are accounted for in the same manner as other loans.

Grant Fund Tax Implications

Before passage of the Tax Cuts and Jobs Act (TCJA), grant funding was considered a contribution to capital for tax purposes. Grants are now subject to tax after the TCJA.

When the amounts are taxed depends on whether funds are recorded as deferred revenue or as a reduction to the cost of plant on a company’s financial statements.

Reductions to the Cost of Plant

Grant proceeds are taxable when received for amounts recorded as reductions to the cost of plant. Fixed assets aren’t reduced by the proceeds but for tax remain at their true cost because the amounts are recognized as taxable income.

This depreciation will allow for a grant income offset but can result in a disparity of when grant funds are received and when depreciation can be deducted, based on when the assets are in fact placed in service.

A company may have high taxable income in the year that grant funds are received if the associated assets aren’t put in service until subsequent years.

Deferred Revenue

For grant funds recorded in deferred revenue, the amounts are still considered taxable income and assets are recorded at their gross cost and can be depreciated.

A company may defer the recognition of these funds for one year under IRC Section 451(c). This deferral can help the grant revenue be recognized in the same year that the associated fixed assets are placed in service so more expenses offset the income.

Bonus Depreciation

Additional consideration should be given to the expiration of bonus depreciation. Starting in 2023 bonus depreciation reduces 20% each year until it’s fully removed. For instance, the bonus depreciation percentage is 60% for assets placed in service in 2024, down from 80% for 2023.

In either situation, the expense offset would occur over a 15-year period and could create a significant tax burden for some companies. This should be a consideration when applying for and receiving any grant funding.

We’re Here to Help

For guidance on round five strategy, project management, applications, or accounting for the USDA ReConnect programs, contact your Moss Adams professional.

Additional Resources